elevated insights

Inspiring thoughts from

Your team at Elevated

There are so many exciting things about running a business—serving new customers, stocking your shelves with inventory, and watching your company grow - to name a few. For most business owners, though, bookkeeping is NOT on that list. And for a good reason. Bookkeeping is critically important, but it can be confusing. Unless you have a background in accounting, things like profit and loss statements, taxes and payroll can seem downright baffling. The process can also be time-consuming and stressful, and there can be major penalties for making mistakes. So, what’s the solution? Simple - hire a professional accounting firm to help you handle your accounting, payroll, and other financials. In this blog, we’ll explain why expert accounting services are crucial for small businesses and how having them can help your company thrive. Let’s dive in. What is Bookkeeping? As we mentioned earlier, accounting is an essential part of any business, but it’s often NOT one business owners enjoy. According to a recent survey by TD Bank, 58% of small business owners reported disliking accounting and find it draining. Broadly defined, bookkeeping is the process of recording financial transactions for your business. As part of the more extensive accounting process, this ongoing task involves everything from record keeping to data management. A good bookkeeper has two primary jobs: making sure the information in the financial record is accurate and reconciling the financial record each month. Regarding educational requirements, most bookkeepers have an associate’s or bachelor’s degree in accounting or a related field. This education gives them a strong background in budget analysis, payroll taxation, and general finance. Some highly-trained bookkeepers may eventually work towards becoming CPAs (Certified Public Accountants), which is one of the highest educational levels in this field. Why Bookkeeping Matters for Small Businesses Let us be clear: accounting is essential for every business, but it’s especially critical for small companies operating with limited budgets. When it’s done well, accounting allows small businesses to organize, analyze, and store their financial information and draw accurate conclusions about the business's financial security. This, in turn, allows a small business to plan for the future. In addition to being functionally important, accounting has tax ramifications. Today, the IRS requires small businesses to maintain records pertaining to profit and loss, income, expenses, and more. Specifically, the IRS requires most small businesses to record the following:

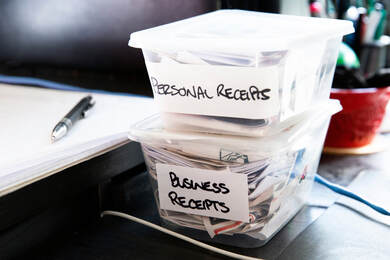

5 Benefits of Small Business Bookkeeping Companies with solid accounting protocols reap the following benefits: 1. More organized records If you’ve ever tried to find a financial document, only to come up short, or been asked to provide documentation of something you can’t locate, you know how frustrating it can be. Fortunately, good accounting services can help you avoid that outcome. Accounting services organize your financial information, categorize essential documents, and help you plan things like bill payments and other expenditures. The result? A more streamlined business for you. 2. More informed financial decisions If you don’t know where you’ve been, how will you get where you’re going? As a business owner, you’ll have to make all sorts of financial decisions for your company, including whether to apply for loans, hire new employees, or open a second location. You can only make these decisions if you have an accurate picture of your company’s finances. Accounting services help ensure that and prevent you from biting off more than you can chew financially. 3. Accurate financial records Financial management and record keeping can easily make or break your company. An estimated 82% of companies that go out of business do so because of poor cash flow management or poor understanding of cash flow. When your accounting is on point, however, you can trust that your financial records are accurate and that your spending is in check. For example, a good bookkeeper will allow you to see exactly how much you spent last month and how much you’re projected to make this month. It’s the easiest and most effective way to avoid cash flow issues and keep your business in the green. 4. Easier tax filing A straightforward tax season is a BIG incentive to invest in professional accounting services. Without them, filing taxes can be scary, expensive, and stressful for small business owners. With the help of a professional bookkeeper, you’ll have easy access to your company’s full year of expenses, receipts, and financial documents, all organized and ready to go to your tax professional. 5. Better budgeting Last but not least, there’s budgeting to consider. Good accounting makes budgeting easy and accurate and allows you to expand, spend, and save when it’s appropriate to do so. When you have clear, organized financial records, it’s easy to review your past information to plan for the future. Need Bookkeeping Services? Hire a Professional You Can Count On There’s no doubt about it: good accounting can make or break a company and spell the difference between success and financial burnout. After all, finances are the foundation of every move a company makes, and it’s impossible to scale if the books are a mess. It’s also impossible to make informed, intelligent decisions that help your company grow - unless you have a comprehensive understanding of your company’s financial health. Fortunately, there’s a skilled team to help you take your accounting to the next level. Here at Elevated Advisory & Accounting, we provide bookkeeping services for small businesses in the Flathead Valley. While DIY accounting may sound simple, it’s a difficult, time-consuming task that’s best left to the professionals. When you hire an expert accounting service, you can rest assured that you’ve got complete, comprehensive financial records and that your company is handling taxes, payroll, and other financials accurately and appropriately. Stop wasting time struggling with accounting and focus on what you do best - growing your business. Ready to speak to your trusted, local accounting team? Contact Elevated Advisory & Accounting today!

11 Comments

|

AuthorWrite something about yourself. No need to be fancy, just an overview. Archives

July 2024

Categories |